nc sales tax on non food items

Any food non-food and prepared food items including soft drinks which are sold at convenience stores that have a connected restaurant are subject to sales and use tax. Prescription Drugs are exempt from the North Carolina sales tax.

Is Food Taxable In North Carolina Taxjar

These categories may have some further qualifications before the special rate applies such.

. FY2004-05 FY2005-06 FY2006-07 FY 2007-08 FY 2008-09 I n M i l l i o n s Prepared. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2.

Is Food Taxable In North Carolina Taxjar Sales Tax On Grocery Items Taxjar Sales Tax On Grocery Items. When calculating the sales tax for this purchase Steve applies the 475 tax rate for North Carolina plus 2 for Wake Countys tax rate and. Counties and cities can charge an additional local sales tax of up.

Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically.

North Carolina has recent rate changes. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on.

Under current law charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay. With local taxes the total sales tax rate is between 6750 and 7500. Nc sales tax on non food items Monday March 14 2022 Edit.

North Carolina statute exempts sales of food from the State sales. Sale and Purchase Exemptions. At a total sales tax rate of 675.

North Carolina Department of Revenue 11509 Page 2. Purchases food items and combines two or more of the items in a package or gift. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Laundries Apparel and Linen Rental Businesses and Other Similar Businesses. Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. What transactions are generally subject to sales tax in North Carolina.

Sales Tax Collections on Food and Prepared Food In Millions 1087 1129. The North Carolina state sales tax rate is 475 and the average NC sales tax after local. Now its time to tackle the intricate stuff.

The bakery items will still be subject to the 2 local rate of tax imposed on qualifying food products. The State and applicable local sales and use tax. The transit and other local rates do not apply to qualifying food.

The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged. 31 rows The state sales tax rate in North Carolina is 4750. Exact tax amount may vary for different items.

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Is Food Taxable In North Carolina Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

What Is Sales Tax A Complete Guide Taxjar

What Is Sales Tax Nexus Learn All About Nexus

North Carolina Income Tax Calculator Smartasset

64 Dollar Grocery Budget Harris Teeter Grocery Budgeting Budget Food Shopping Harris Teeter

North Carolina Sales Tax Small Business Guide Truic

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Review Flame Tree Barbecue At Disney S Animal Kingdom The Disney Food Blog Disney Food Blog Disney Food Food

Is Food Taxable In North Carolina Taxjar

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

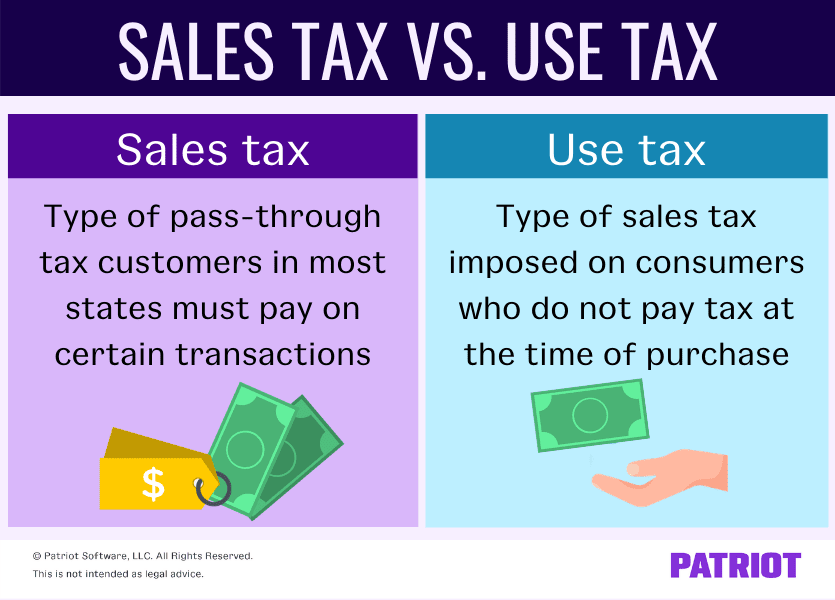

Sales Tax Vs Use Tax How They Work Who Pays More

Understanding Sales Tax With Printify Printify Sales Tax Printify Understanding

Sales Tax On Grocery Items Taxjar

Costco Demos In Florida And North Carolina Spreading Soul North Carolina Carolina Florida

Pin By Xinedonovan On 2021 Tax Receipts Card Holder Credit Card Cards

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation